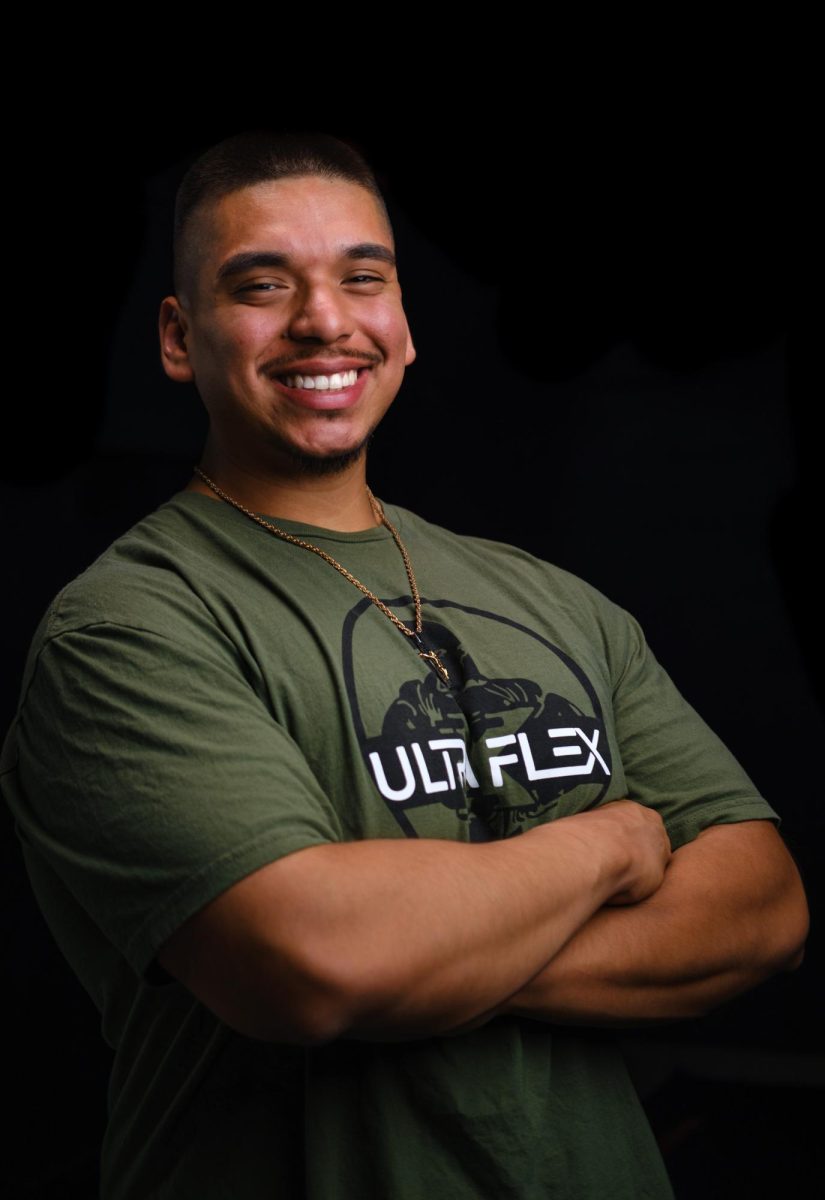

San Pedro Resident Isaiah Hicks’ apartment is plagued with the kind of infrastructure issues that state Proposition 5 could potentially help address: Aging pipes, chipped paint, cracks in the stairs.

“The plumbing in my apartment isn’t good. I continuously have clogged sinks and my shower drain as well,” Hicks said. “It’s dangerous because I could easily slip and fall. I have to be very careful going up the steps.”

Prop. 5 would lower the voting requirement needed to allow local governments in California to borrow money for infrastructure and to provide assistance with low-income housing. The measure would lower the votes required from two-thirds to 55% — while requiring local governments to do annual audits on what is spent and allow oversight from independent committees.

Hicks said it’s because he worries, despite the auditing requirements, that the government won’t use the funding wisely and feels that residents who are already struggling to make ends meet should not have to foot the bill.

He’s not alone. “Seven in ten residents feel they are paying more than they should in state and local taxes—the highest share since PPIC first asked this question 20 years ago, with 31% saying they pay much more,” according to a Public Policy Institute of California report in 2023.

Supporters say the measure is needed to help communities rebuild and improve infrastructure, support people experiencing homelessness or those who need help paying their rent — and it could create more jobs in the process.

Hicks said he doesn’t like that only 55% of voters would need to approve such bonds — instead of a two-thirds majority.

“The taxes I pay now are not being utilized for the infrastructure around me and just for example, I still see potholes on the streets still. That has been a continuing issue for me because it is the leading cause of getting flat tires and needing to get a wheel alignment,” Hicks said. “I think paying higher taxes to fund infrastructure and low- and middle-class housing will not be put toward that need properly, or even at all. I thought that is what our taxes were already being put toward.”

On the other hand, Bethlehem Makonnen, who is studying to be an attorney, agrees with the measure.

“I definitely support it. I think that using the tax system as a resource or as a tool to redistribute wealth here in the United States or in our state governments and local governments is an essential tool in trying to bridge the gap between low income and wealthy individuals,” Makonnen said. “The whole purpose of paying taxes [is] a civic duty, really used to fund programs or services for our communities, for the betterment of our community.”

Increasing taxes to fund public services can help everyone involved, Makonnen added.

“Using tax dollars towards funding essential programs or helping balance some of the inequalities that we see in our economy and in our society is really a good way, in my opinion, to reduce poverty and inequality and fund social services that can make an impact for many people,” Makonnen said. “I think infrastructure is something that must be revised periodically, especially as we’re seeing shifts in climate and other factors that are changing the way society and environment currently is.”

Makonnen acknowledged people are struggling with inflation and other economic issues, so that’s one part of the measure that could hurt people even more — but there are other ways of stemming problems related to that.

“I do think a lot of people have seen impacts of inflation as a byproduct of the pandemic but with that being said, I do think that there has been some intentional legislation and efforts being made to combat that,” Makonnen said.

Similarly, Christiane Rios said she agrees with the proposal: “I’m fine with that because we should be able to have safe buildings. We should be able to have safe freeways, proper places to be and not have to worry about, for instance, buildings collapsing or freeways being shut down because they’re not getting fixed. Like the 53 freeway, the one that’s shut down for construction. I’d rather get things done quicker with our tax dollars than have to be always worried about how I have to take another route.”

Rios, who said she and her roommates split the rent, said that since doesn’t own her own home, more property taxes won’t affect her as much — though their landlord could increase the rent a little to offset the tax.

Disclosure: Christiane Rios is a journalism major at Cal State LA and a classmate of the author.